In This Issue

Client News

Avignon Capital Selects Yardi Voyager 7S for European Portfolio Management »

Bartra Capital Property Group Manages Portfolio Growth with Yardi Voyager 7S »

Arabian Centres Selects Yardi Voyager 7S for Retail Portfolio Management »

Client in Focus

An Interview With NewRiver REIT »

Yardi News

Yardi is Named one of the “10 Fastest Growing Cloud Solution Provider Companies” by Insights Success »

Software to Support Your Front of House »

Product & Technology

Yardi Further Mobilises Commercial Property Customer Service with COMMERCIALCafé Tenant App »

Smarter Than Ever Business Intelligence »

Yardi Voyager for Germany Reaches New Milestone »

Industry Trends

Transforming Resident Lifestyles in the Build-to-Rent Market - Property Week Perspectives with Stephanie Smith, Yardi »

Residents Rule The Build-to-Rent Roost – Northern Powerhouse Property Management Think Tank »

Retail Technology, Runs on Yardi, by Yardi Senior Vice President, Rob Teel »

Is Your Real Estate Portfolio Resilient Enough? »

Events

YASC Europe – Save the Date! »

Upcoming Yardi Client Usergroups »

Find Us at Industry Events Find Us at Industry Events

Yardi is Honoured to be Shortlisted for Proptech Company of the Year »

How to Shift from Big Data to Smart Data – Yardi at MIPIM »

UK Rent Awards & Conference, London – 20 April »

REALTY, Brussels – 16-18 May »

Contact

United Kingdom

+44 (0) 1908 308400

The Netherlands

+31 (0) 20 565 0050

Germany

+49 (0) 6131 14076 3

europe@yardi.com

www.yardi.com/eu/

|

Industry Trends

Is Your Real Estate Portfolio Resilient Enough?

By Sebastien Lieblich, Global Head of Index Management Research - MSCI

Amid recent worldwide political, economic and market uncertainty, how can you increase resilience of your real estate portfolio? The answer to this question boils down to prudent use of three simple portfolio construction strategies: Asset selection, sector allocation and global diversification.

The inherent heterogeneity of private real estate markets complicates the application of these strategies. Asset selection tends to be particularly important for smaller portfolios since they may consist of only a few assets and are hence dominated by asset-specific risk. Only the largest portfolios can hope to allocate in sufficient volume to provide diversified sector or market exposure.

Proper asset selection is crucial in private real estate. Every property is unique and hence, no portfolio, whatever its size, can perfectly represent the market. For this reason, 50% to 60% of the tracking error between a private real estate portfolio and its benchmark is generally attributable to asset selection. Smaller portfolios with proportionately larger exposures to individual assets are even more exposed to this phenomenon.

Variations in portfolio returns are driven by the unique characteristics of each asset, i.e., its physical attributes and location through to its lease structure and the strength of its tenants. While it is impossible to perfectly diversify away asset-specific risk, the resilience of portfolios can be enhanced by combining real estate assets with varying characteristics and by actively managing the physical and cash flow characteristics of the assets themselves.

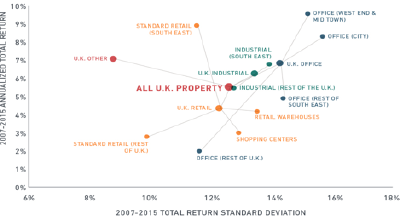

Sector allocation offers another opportunity to build portfolio resilience. By allocating capital to the right sectors, it is possible to strengthen the defensive nature of the portfolio. For example, the annualised return of U.K. office assets topped those of U.K. retail assets by 250 basis points during the 2007-2015 period. Looking at the sub-sector level, performance varied even more over the same period, as can be seen below.

RETURNS OF UK PRIVATE REAL ESTATE ASSETS VARIED GREATLY BY SECTOR AND SUB-SECTOR

Source: MSCI – Global Intel

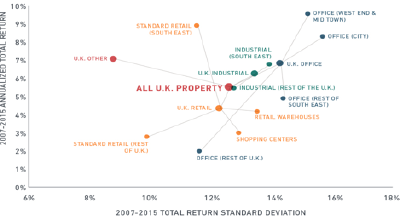

Finally, global diversification has historically offered even more resilience benefits than sector allocation up front. Internationally, there has been a wide range of performance, with over 13 percentage points of difference in the annualised total return of the best- and worst-performing markets in the eight-year period from 2007, as can be seen below. This large gulf in performance highlights both the potential of global diversification and the importance of managing it properly.

Mind the gap: return differences between best and worst national markets

Most private real estate portfolios are too small to take advantage of these global diversification benefits and thus exhibit a strong home bias. Consequently, cross-border correlations remain low. Funds that are big enough to exploit these low correlations can produce greater portfolio resilience.

The basic strategies of asset selection, sector allocation and global diversification can be borrowed from publicly listed asset classes. However, they must be applied carefully, given the unique characteristics of the private real estate market. Private real estate market data built from the bottom up with detailed asset-level cash flows can help investors optimise the mix of these strategies in a way that is suitable for their portfolios.

The author thanks Bryan Reid and Will Robson for their contributions to this post. This post is reproduced from the MSCI website with their kind permission.

|